Supplies are Limited - Don't Delay

I search the world to find the best deals and titles I can from legitimate suppliers, distributors, and manufacturers. ~ Steve

-

Hellraiser: Tetralogy [4K UHD] (Special Edition)

Regular price $70.32 USDRegular priceUnit price / per -

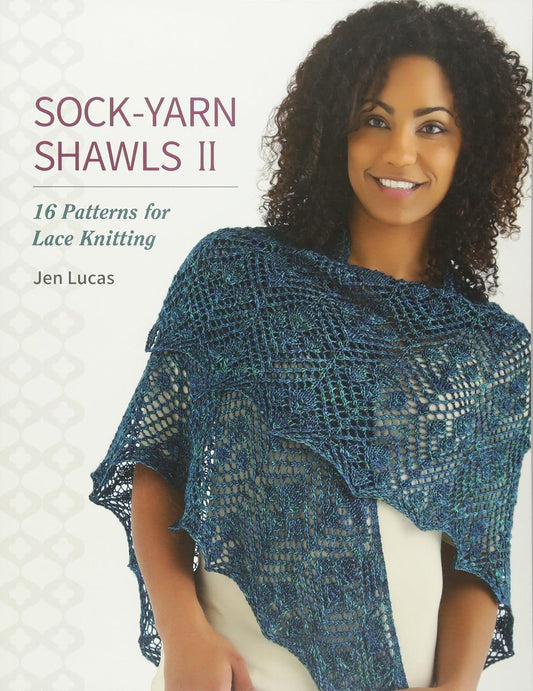

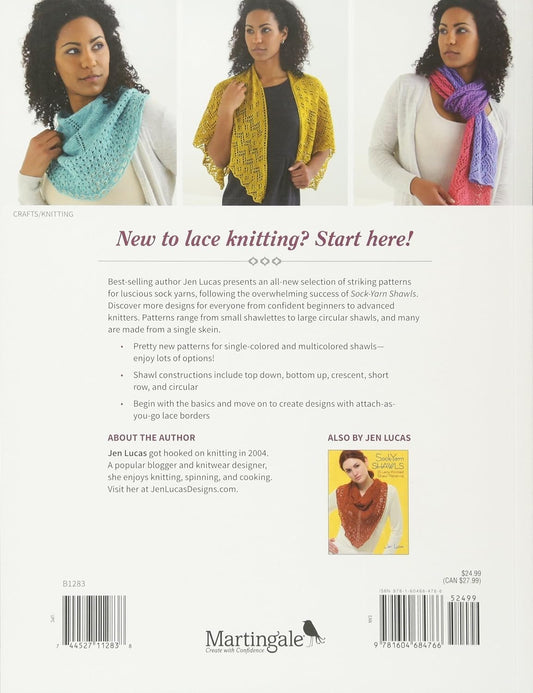

Sock-Yarn Shawls II: 16 Patterns for Lace Knitting

Regular price $18.15 USDRegular priceUnit price / per -

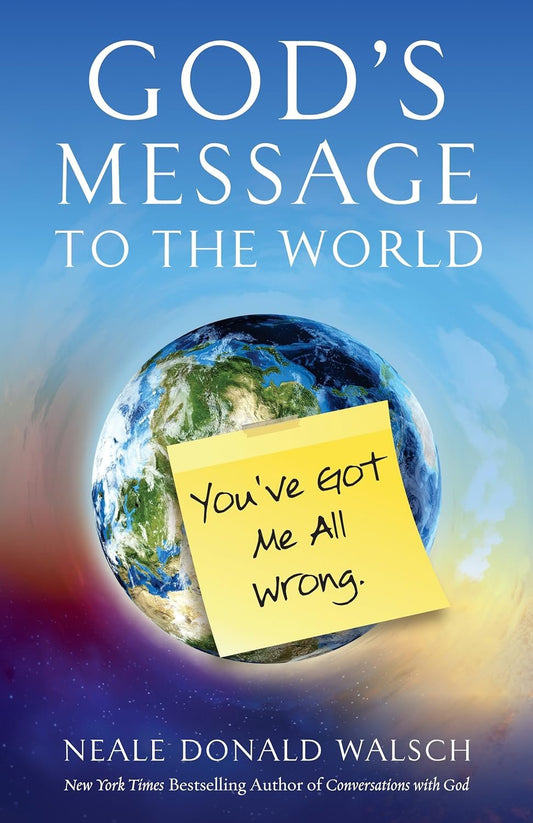

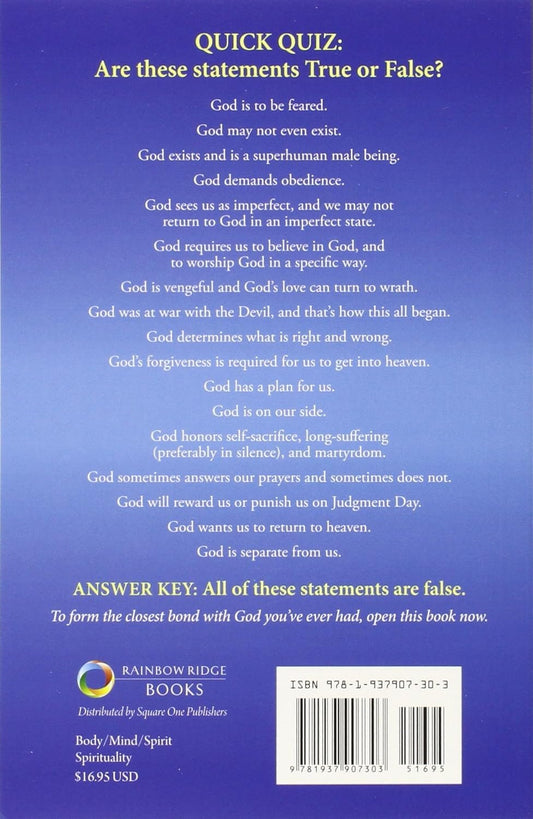

God's Message to the World: You've Got Me All Wrong

Regular price $17.21 USDRegular priceUnit price / per -

Cellarful of Noise

Regular price $17.33 USDRegular priceUnit price / per -

Race Cars: A children's book about white privilege

Regular price $12.53 USDRegular priceUnit price / per -

Harry Potter Deathly Hallows Hardcover Ruled Journal

Regular price $16.71 USDRegular priceUnit price / per -

The Father: A Revenge

Regular price $24.90 USDRegular priceUnit price / per -

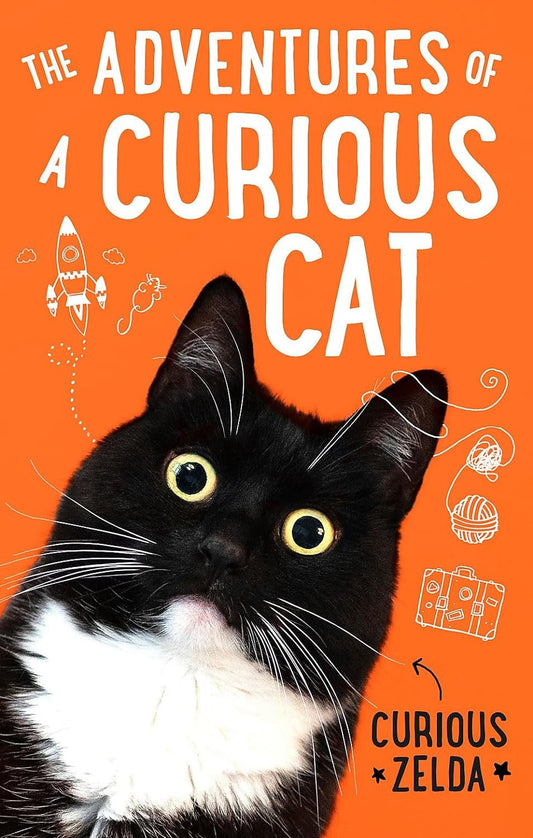

The Adventures of a Curious Cat: wit and wisdom from Curious Zelda, purrfect for cats and their humans

Regular price $19.56 USDRegular priceUnit price / per -

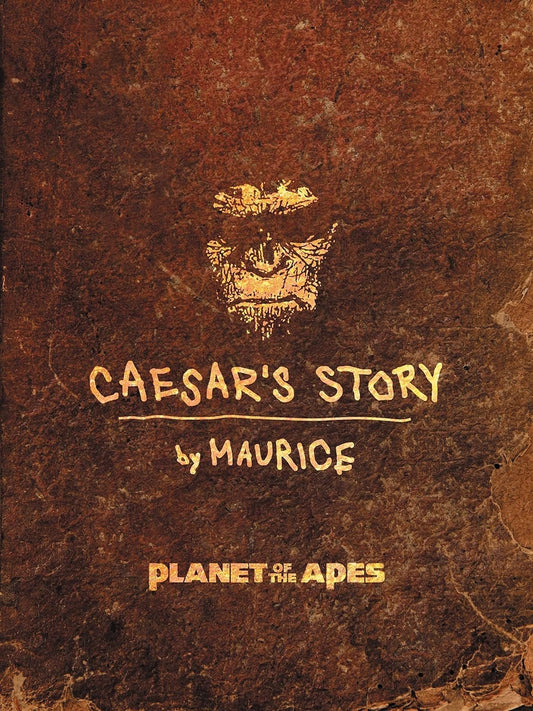

Planet of the Apes: Caesar's Story

Regular price $13.66 USDRegular priceUnit price / per -

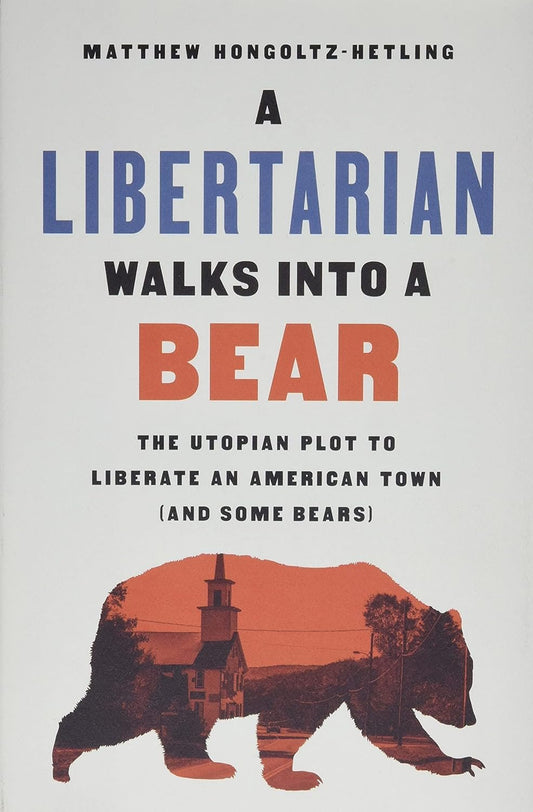

A Libertarian Walks Into a Bear: The Utopian Plot to Liberate an American Town (And Some Bears)

Regular price $19.38 USDRegular priceUnit price / per -

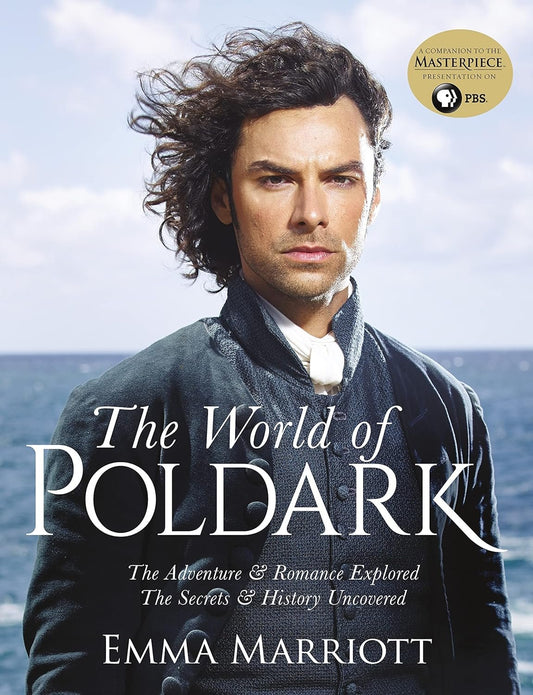

The World of Poldark

Regular price $15.51 USDRegular priceUnit price / per -

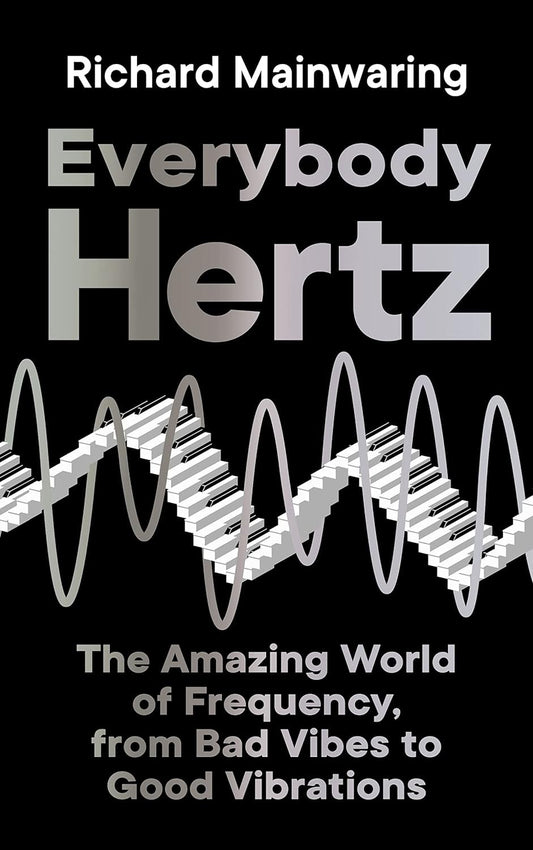

Everybody Hertz

Regular price $28.24 USDRegular priceUnit price / per -

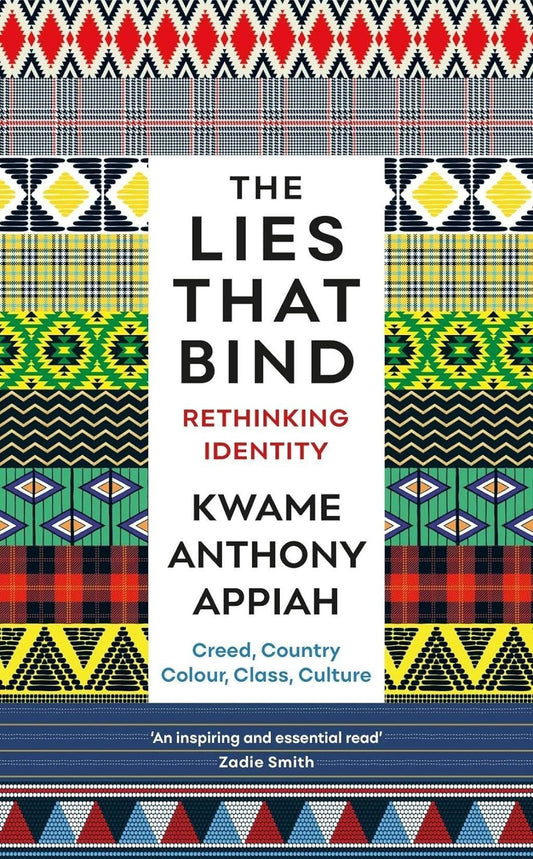

The Lies That Bind: Rethinking Identity

Regular price $16.18 USDRegular priceUnit price / per -

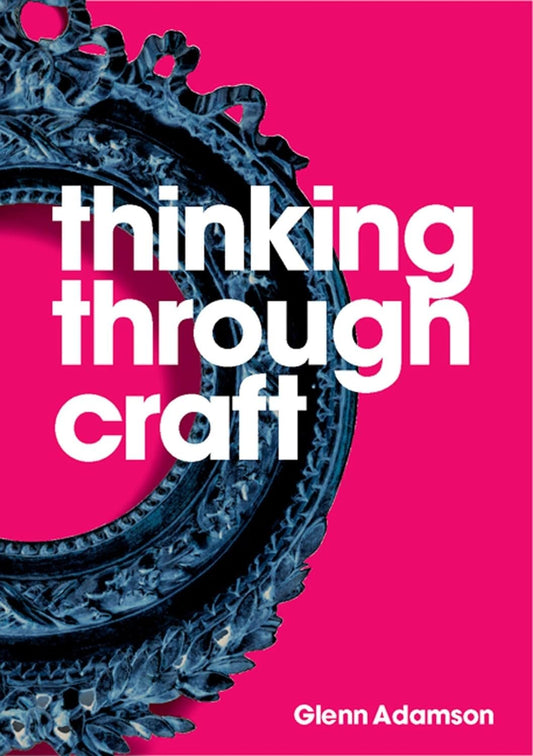

Thinking Through Craft

Regular price $34.88 USDRegular priceUnit price / per -

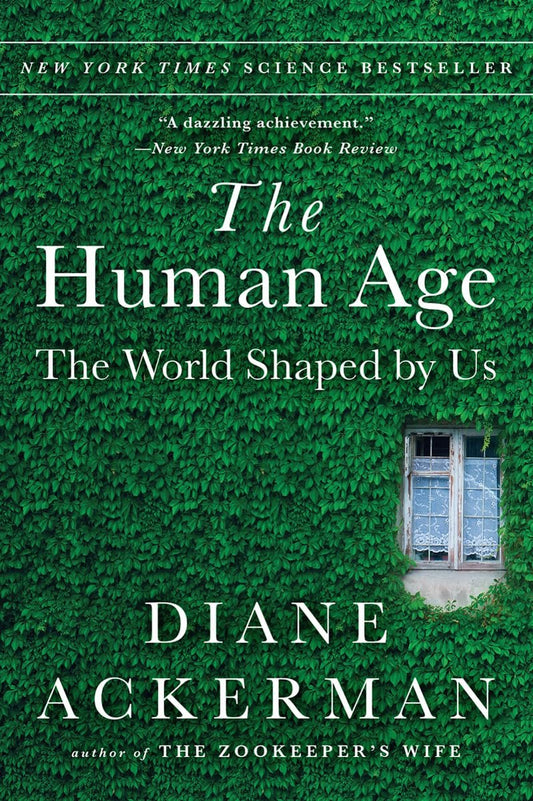

The Human Age: The World Shaped By Us

Regular price $14.55 USDRegular priceUnit price / per -

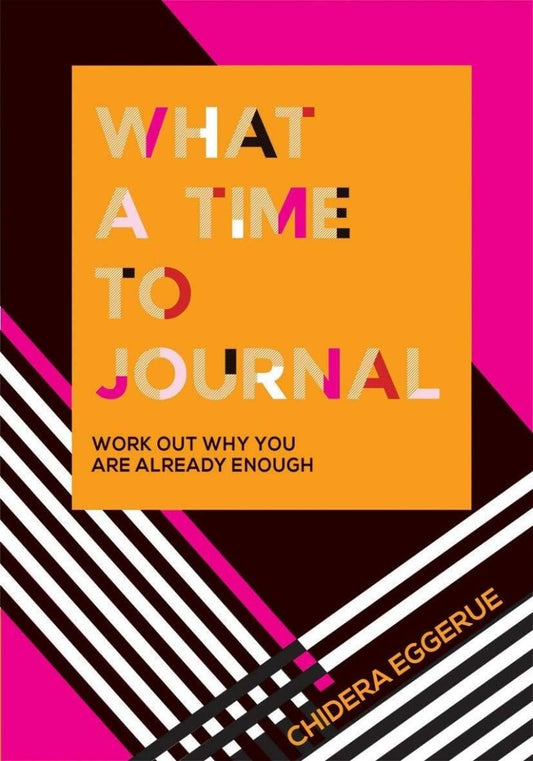

What a Time to Journal: Work Out Why You Are Already Enough

Regular price $18.69 USDRegular priceUnit price / per -

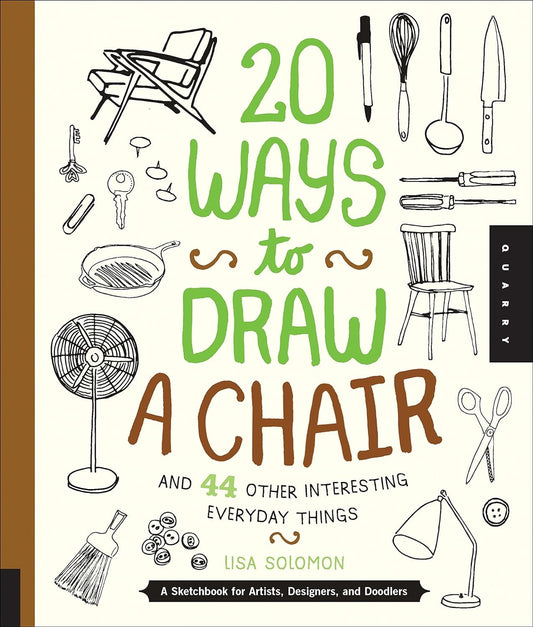

20 Ways to Draw a Chair and 44 Other Interesting Everyday Things: A Sketchbook for Artists, Designers, and Doodlers

Regular price $16.72 USDRegular priceUnit price / per -

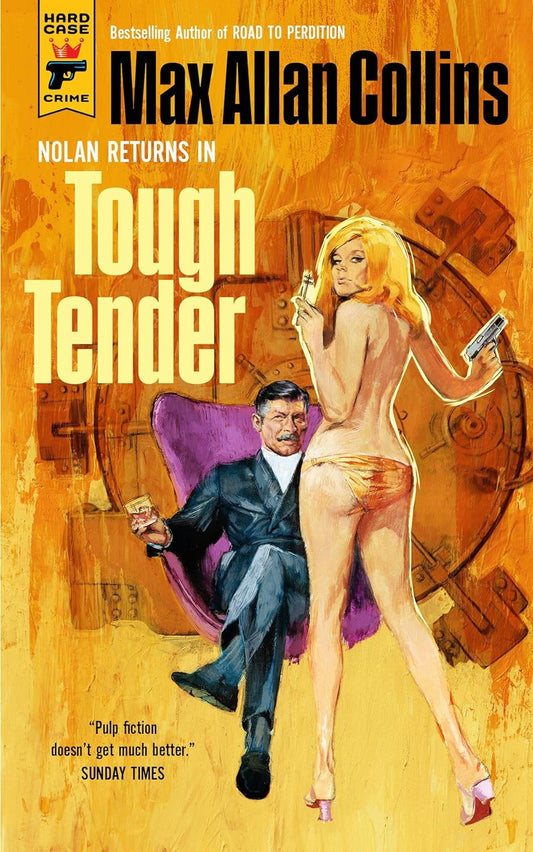

Tough Tender

Regular price $13.64 USDRegular priceUnit price / per -

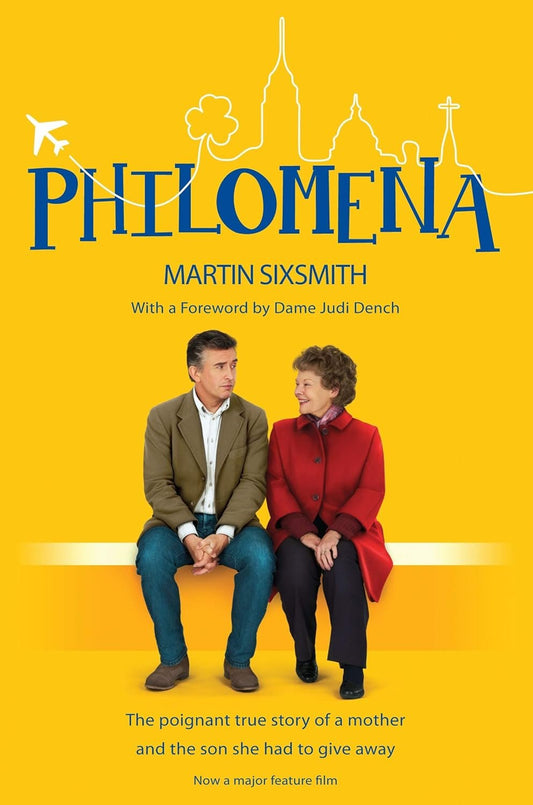

Philomena: The True Story Of A Mother And The Son She Had To Give Away

Regular price $19.48 USDRegular priceUnit price / per -

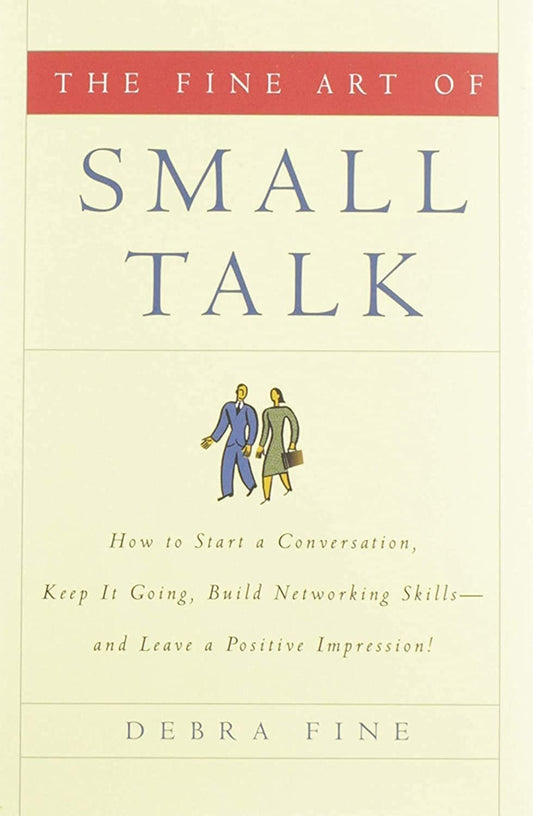

The Fine Art of Small Talk: How To Start a Conversation, Keep It Going, Build Networking Skills -- and Leave a Positive Impression!

Regular price $26.44 USDRegular priceUnit price / per -

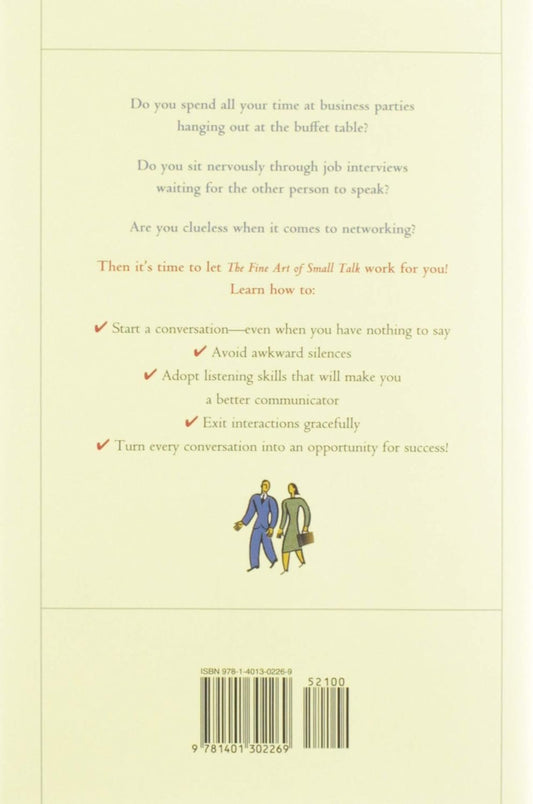

DreamWorks Dragons: Adventures with Dragons: A Pop-Up History (1)

Regular price $33.92 USDRegular priceUnit price / per -

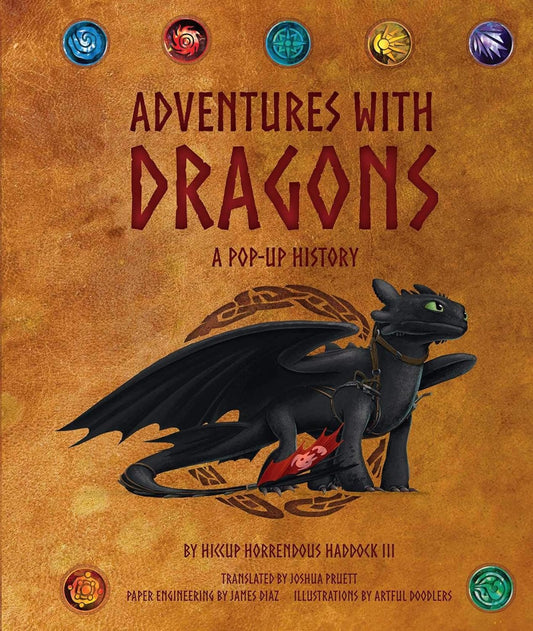

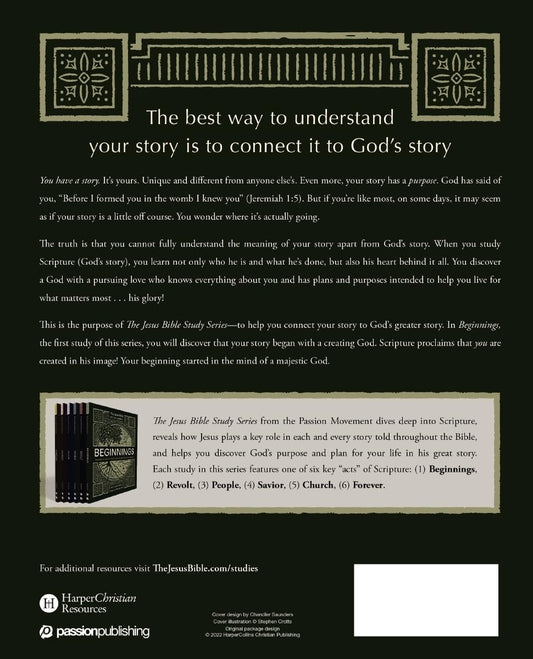

Beginnings Bible Study Guide: The Story of How All Things Were Created by God and for God (Jesus Bible Study Series)

Regular price $18.03 USDRegular priceUnit price / per -

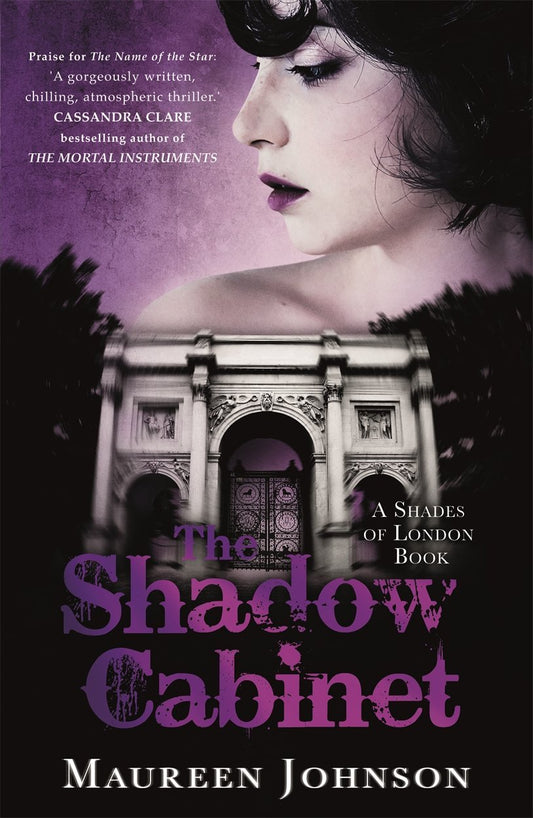

The Shadow Cabinet: A Shades of London Novel

Regular price $12.41 USDRegular priceUnit price / per -

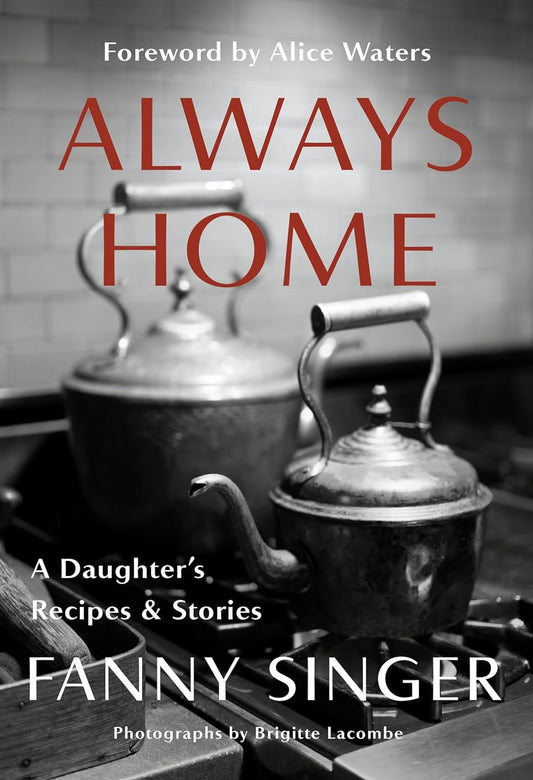

Always Home: A Daughter's Recipes & Stories: Foreword by Alice Waters

Regular price $29.74 USDRegular priceUnit price / per

![Hellraiser: Tetralogy [4K UHD] (Special Edition)](http://zxasqw.com/cdn/shop/files/medium_941bb094-b3c4-4006-825a-036059960771.jpg?v=1712760425&width=533)